Entrepreneurship Support Fund (ESF)

Entrepreneurship Support Fund (ESF) Startup Fund Bangladesh Bank

Startup Fund Bangladesh Bank LEED Certification Procedures for Industrial Green Building

LEED Certification Procedures for Industrial Green Building Bangladesh: A New Horizon For Investment

Bangladesh: A New Horizon For Investment Industrial sector of Bangladesh is a role model for Haiti

Industrial sector of Bangladesh is a role model for Haiti Focus on raising private sector investment for GDP growth

Focus on raising private sector investment for GDP growth Duty Free Quota Free export items to China

Duty Free Quota Free export items to China Bangladesh’s $50bn RMG export target

Bangladesh’s $50bn RMG export target Export of jute stick charcoal fetches Tk 140m from China

Export of jute stick charcoal fetches Tk 140m from China Investment scenario of Bangladesh

Investment scenario of Bangladesh

Green Finance Projects in Bangladesh

Bangladesh Bank Initiatives for Promoting Investments in Green Projects

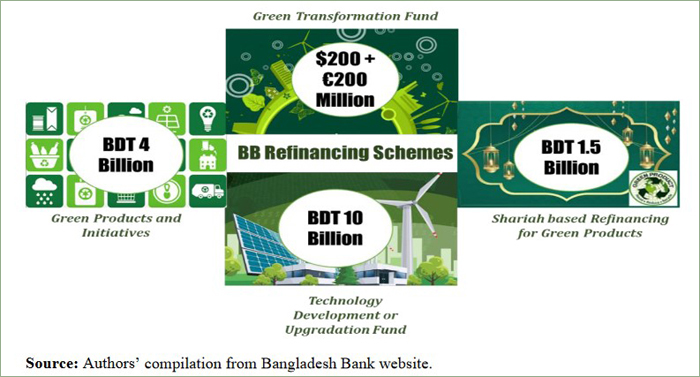

Bangladesh Bank has four direct refinancing schemes for promoting investments in green projects (Figure 1). These are: (i) BDT 4 billion equivalent refinance scheme for investing in environment-friendly products or initiatives, (ii) BDT 1.5 billion equivalent refinance scheme for Islamic banks and FIs for investment in green products or initiatives, (iii) green technology fund (GTF) worth USD 200 million to import green machineries and 200 million EURO to import green machineries as well as industrial raw materials, and (vi) BDT 10 billion worth technology development or upgradation Fund (TDF) for 32 industrial sectors mentioned in Bangladesh Export Policy 2018–21 (Bangladesh Bank, 2022).

In addition to the above-mentioned refinancing schemes, Bangladesh Bank has set following targets for other banks or FIs to accelerate the scale of financing for green investment projects. These targets are non-binding in nature. However, under ESRM Guideline 2017, banks and FIs receive certain benefits or incentives for meeting these targets (Bangladesh Bank, 2017).

- According to Bangladesh Bank’s GBCSRD (the Green Banking and CSR Department) Circular No. 04/2014, from January 2016 onwards, the minimum target of direct green finance was set at 5 per cent of the total funded loan disbursement or investment for all banks and FIs.

- In 2015, through GBCSRD Circular No. 04/2015, banks and FIs were instructed to form a ‘Climate Risk Fund’ having allocation at least 10 per cent of their corporate social responsibility (CSR) budget.

Later, from September 2020 onwards the minimum target of green finance was set at 5 per cent of the total funded term loan disbursement/investment for all banks and FIs (Bangladesh Bank’s Sustainable Finance Department (SFD) Circular Letter No. 05/2020).

Green Transformation Fund

Refinance Scheme for Environment Friendly Products/Projects/Initiatives Green Transformation Fund

Environment Friendly Brick Manufacturing:

IIDFC was one of the pioneers of introducing environment friendly Hybrid Hoffman Kiln (HHK) technology in the brick making industry of the country. IIDFC’s Clean Development Mechanism (CDM) project helped to establish the first HHK of the country in collaboration with UNDP & the World Bank. We alone have 09 energy efficient HHK units under our CDM project umbrella, which are saving 30,000-32,000 tons of Green House Gas (GHG) annually. With a vision to promote green technologies, IIDFC always encourages projects like Tunnel Kilns, HHKs and Non-fired Block Bricks i.e. Autoclave (AAC), Concrete Blocks etc.

To facilitate the clients with a greener vision, we have expertise in arranging Bangladesh Bank refinance scheme, ADB’s fund for Energy Efficient Brick kilns and collaboration with various development agencies.

Industrial Energy Efficiency Improvement:

Being the first local stakeholder, IIDFC set its footprint in Industrial Energy Efficiency Improvement Financing several years back. By an agreement with the Asian Development Bank (ADB), IIDFC provided technical assistance to conduct energy audits in 120 industries under six different sectors i.e. Steel, Cement, Textile/RMG, Sugar, Paper etc. We also had a Term Loan facility of 06 million US dollar from ADB for financing such projects.

IIDFC has its fully equipped team for providing One Stop solution in Industrial Energy Efficiency Improvement Financing. Starting from Energy Audit arranging, Walk-through Energy Audit, report preparing and applying for financing we have all solutions for you under one roof. The experience of working closely with ADB, USAID etc in this particular project keeps us one step ahead in arranging low cost fund.

Manufacturing of Energy Efficient products like LED Bulb/Tube lights including assembling plants and assembly plants for Solar PV cell/array are also promoted by us.

Green Industry:

Sustainable Development involves a wholesome approach to the overall operations of a project. This starts from designing the project to construction to obtaining United States Green Building Council’s (USGBC) LEED certification. IIDFC provides package solution in this area for the whole process. Special refinance fund from the Bangladesh Bank is arranged for the eligible projects.

Waste Management:

Being one of the most densely population, Bangladesh’s nature & environment is badly affected by the waste materials generated by Industrial processes. These wastes are polluting the soil and water bodies thus risking wildlife. To reduce the harmful effects of industrialization IIDFC promotes small to large scale waste management projects i.e. Effluent Treatment Plant (ETP), Water Treatment Plant (WTP) and Solid Waste Management processes. Financing is done at a much cheaper rate using Bangladesh Bank’s re-finance scheme.

Recycling Industry:

With a strong footprint in the Paper & Plastic industry IIDFC extends its scopes for financing Recycling plants in these sectors. We arrange re-finance facility through Bangladesh Bank to encourage recycling practices and save the nature.